Questions Lenders Will Ask

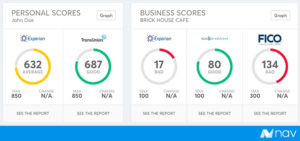

As a liaison to hundreds of clients, my first question is always the following: What can we leverage? We always therefore want to know: – What’s your industry? – Is there any collateral? Do you even know what there is to collateralize? – What’s your FICO? – What type and amounts of debt do you […]